- Automate

- Case Study

- Banking

Alior Bank Voice Bot Handles Nearly 100% of the Call Centre Traffic

Voice bot

Chatbot

SentiOne Automate Platform

Call automation rate

Intent recognition accuracy

Daily conversations conducted by the voice bot

Challenge

The implementation of the voice bot was driven not only by business needs (automating calls in the Call Centre) or the bank’s digitisation strategy but also as a response to current global technological and social trends related to hyper-automation. During the implementation of the described project, Alior Bank primarily focused on customer convenience – using natural language in communication with the voice bot and defining the conversation topic is more intuitive and natural, even for older individuals. The implementation efforts coincided with the beginning of the COVID-19 pandemic when in-person human interactions were significantly limited, further emphasising the need for the most automated, accessible 24/7, and, above all, intuitive solution for current and potential Alior Bank customers.

Alior Bank was looking for a solution to:

- Implement effective call automation in the Call Centre

- Provide modern contact channels

- Reduce the workload of the Call Centre agents

Solution

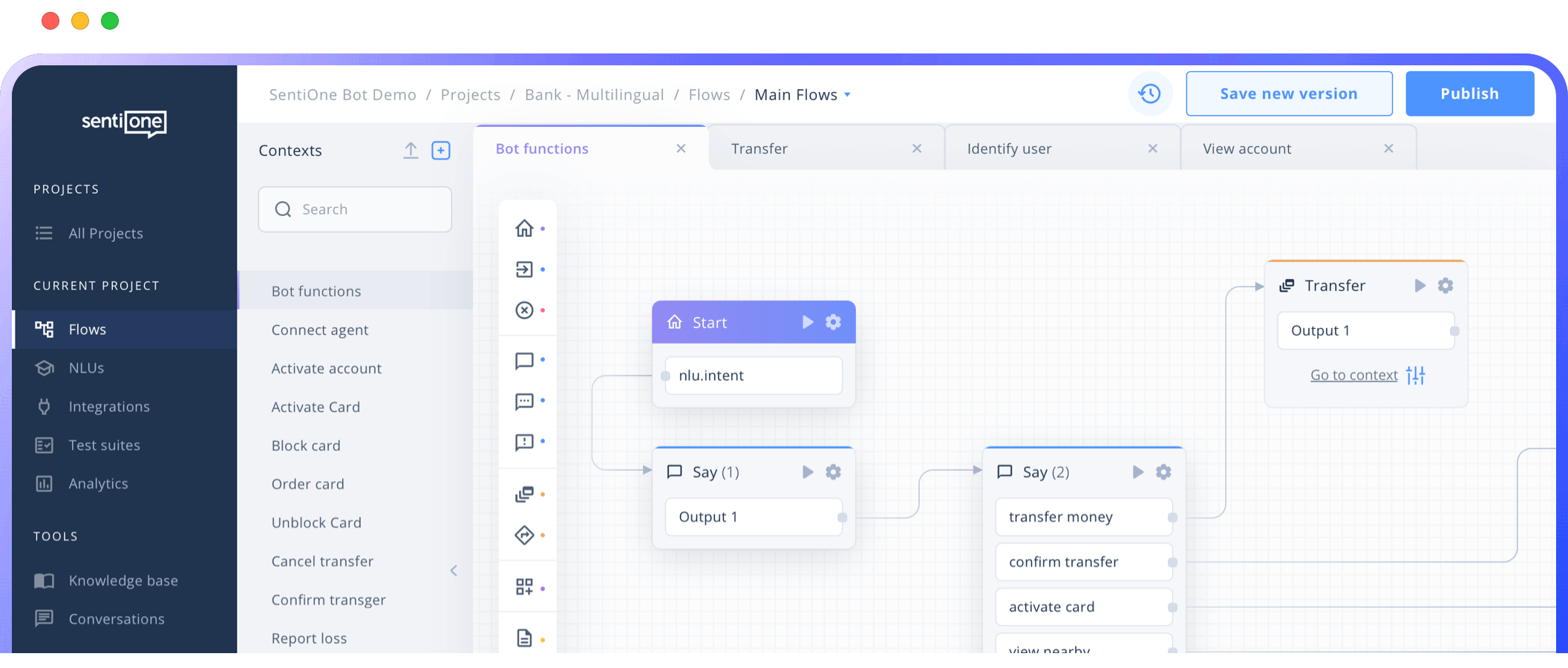

In 2021, Alior Bank implemented a voice bot called InfoNina in the Call Centre. InfoNina is an AI-based bot created in collaboration with Alfavox and SentiOne. Initially, the bot replaced the traditional IVR, where customers were selecting conversation topics. The bank has been regularly introducing additional call steering and informational processes (where InfoNina responds to questions, eliminating the need to contact a human agent) and gradually increasing the percentage of calls directed to the bot. Currently, the virtual assistant handles almost 100% of the traffic in the bank’s Call Centre. Without waiting in queues, a customer can quickly find out how to activate a card, unlock online banking, or inquire about a branch address – these are just a few examples. The voice bot can handle over 140 call steering and informational processes in total.

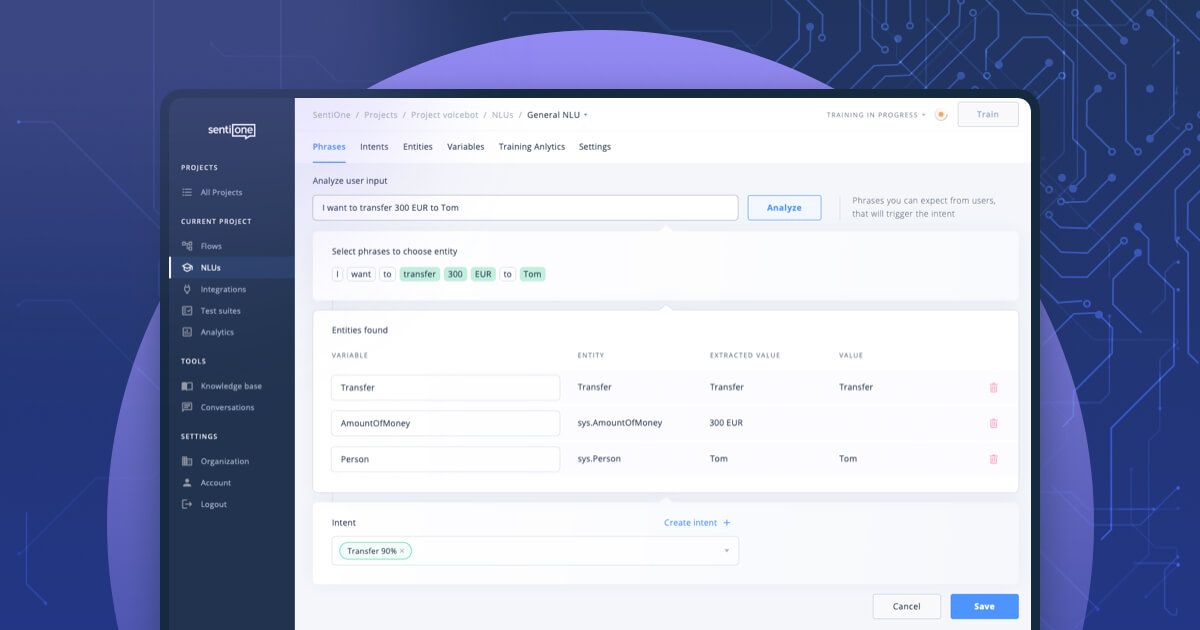

InfoNina can precisely recognise the customer’s intent and, depending on the topic, transfer them to the appropriate consultant or handle their issue independently. Automation in the project was achieved by using various technologies that simulate human communication by the bot, including Natural Language Understanding and Natural Language Processing. The high level of intent recognition (or, in other words, expressions used by customers) directed to InfoNina is the result of additional training of the natural language understanding engine using historical conversations between the bank’s consultants and customers.

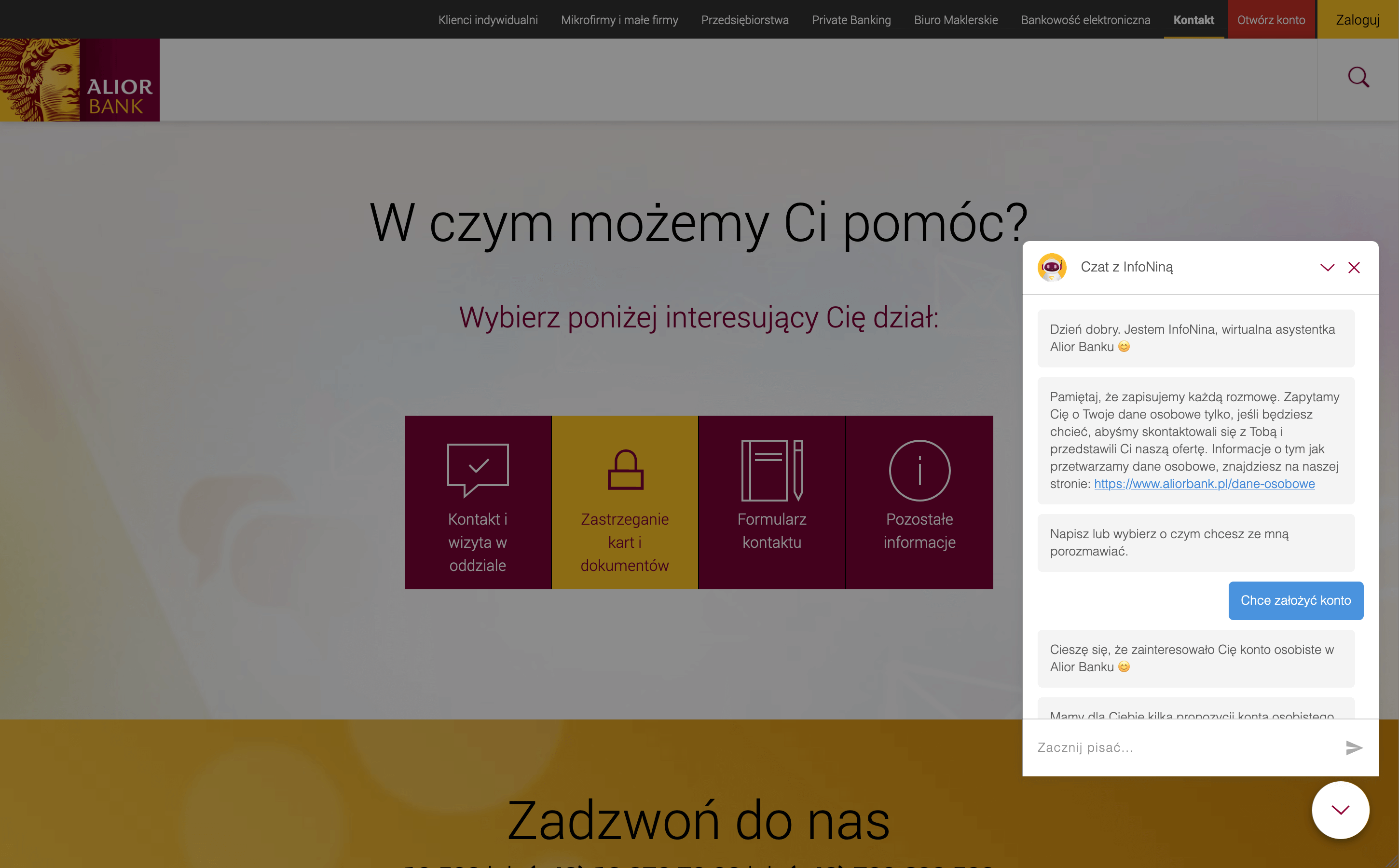

A crucial step in the bot’s development was the implementation of transactional processes. By enabling transactional support, the bot can verify the customer’s identity and perform selected transactions related to their banking products (such as providing an account balance or information about a loan). The bank continues to work on launching additional processes, further expanding the range of services offered by the bot in the near future. It’s worth noting that since June 2023, InfoNina is also available as a chatbot on Alior Bank’s website. In this new support channel, the virtual assistant provides basic information related to banking products and also presents loan and deposit offers. The chatbot’s scope of support is continuously expanding.

InfoNina Chatbot

Results

After nearly 3 years since its implementation, the voice bot has become the first line of support for many Alior Bank customers. The project has improved agent productivity, reduced customer service time, and enhanced call redirection accuracy compared to traditional IVR. Currently, the call automation rate is nearly 55%, and the average handling time has been reduced by 15%. The bot can recognise over 650 customer intents, and additionally, over 90% of queries are directed straight to the relevant informational process or consultant in cases where the bot does not handle the specific topic.

In May 2023, the University of Wrocław awarded Alior Bank the “Prosta Polszczyzna” (Plain Polish) certificate. This recognition confirms that the voice bot meets the requirements of plain language standards, making it understandable and user-friendly.

The technical advancement, high level of customer intent understanding, and the wide range of processes handled by InfoNina have also been recognised in industry competitions worldwide:

- Global Finance Awards 2023: Top Innovator in AI

- TechnoBiznes 2023: Banking

- Celent Model Bank Awards 2022: Customer Service

- Retail Banker International Global Awards 2022: Best Banking Use of AI

For us, good relationships and positive customer experiences are of the utmost importance. We are delighted with our collaboration with SentiOne and the achievements of InfoNina. The virtual assistant has become the first point of contact with customers, and, thanks to SentiOne's advanced NLU, it recognizes over 90% of intents.