Hungary’s Automotive Growth: Innovation Up, Sentiment Flat

The automotive industry powers nearly 21% of Hungary’s exports and employs over 150,000 people – making it the cornerstone of the country’s industrial landscape. With global players like BMW, Mercedes-Benz, Audi, and BYD investing heavily in production facilities, Hungary has rapidly become a manufacturing magnet in Central Europe.

But while production ramps up, public sentiment tells a more nuanced story.

Using SentiOne’s social listening platform, we analyzed 4,000+ online mentions of Hungary’s automotive sector from July 2024 to July 2025. The goal: uncover what people are really saying – across news, social media, and forums – about the industry’s performance, labor conditions, and transition to electric mobility.

The data reveals a mixed landscape: factory expansions and EV ambitions coexist with concerns over labor relations, service experiences, and long-term trust.

A Year in Review: Volume and Spikes in Conversation

The number of mentions remained stable until early 2025 — then surged in April and May, with more than 600 mentions per month, before sharply dropping again in July.

This spike correlates with two notable events:

- February 2025: Workers at Lear Corporation Hungary (supplier to Audi Győr) announced a potential strike due to unresolved wage disputes.

- March 2025: Mercedes-Benz announced an 800,000 HUF profit-sharing bonus for workers at its Kecskemét factory, based on 2024 performance.

These events highlight how labor and compensation continue to dominate the public discourse, especially in relation to Hungary’s foreign-led automotive ecosystem.

All insights in this report were generated using SentiOne’s social listening platform, which enables brands and institutions to track real-time sentiment, detect emerging risks, and make data-driven decisions based on public discourse. From executive dashboards to granular mention analysis, SentiOne gives stakeholders a clear window into how they’re perceived — and why it matters.

📊 Where the Conversation Happens

The majority of mentions (54%) come from news websites, followed by Twitter/X (21%), blogs (11%), and Facebook (10%). The format of this data shows that conversations are largely informational and top-down, rather than community-driven.

Additionally, over 83% of the audience is male, indicating a gender-skewed discussion space — especially in forums around repairs, performance, and brand loyalty.

🧠 Public Sentiment: Mostly Neutral, With Strategic Swings

Most mentions are neutral, but two small peaks stand out:

- A negative sentiment bump in February, corresponding with the labor dispute

- A positive sentiment spike in May, likely tied to the Mercedes-Benz bonus

👉 Interpretation: These sentiment shifts aren’t just noise — they reveal how labor conditions and direct benefits (or lack thereof) quickly shape public trust. In a market driven by international players, local perception becomes a strategic asset.

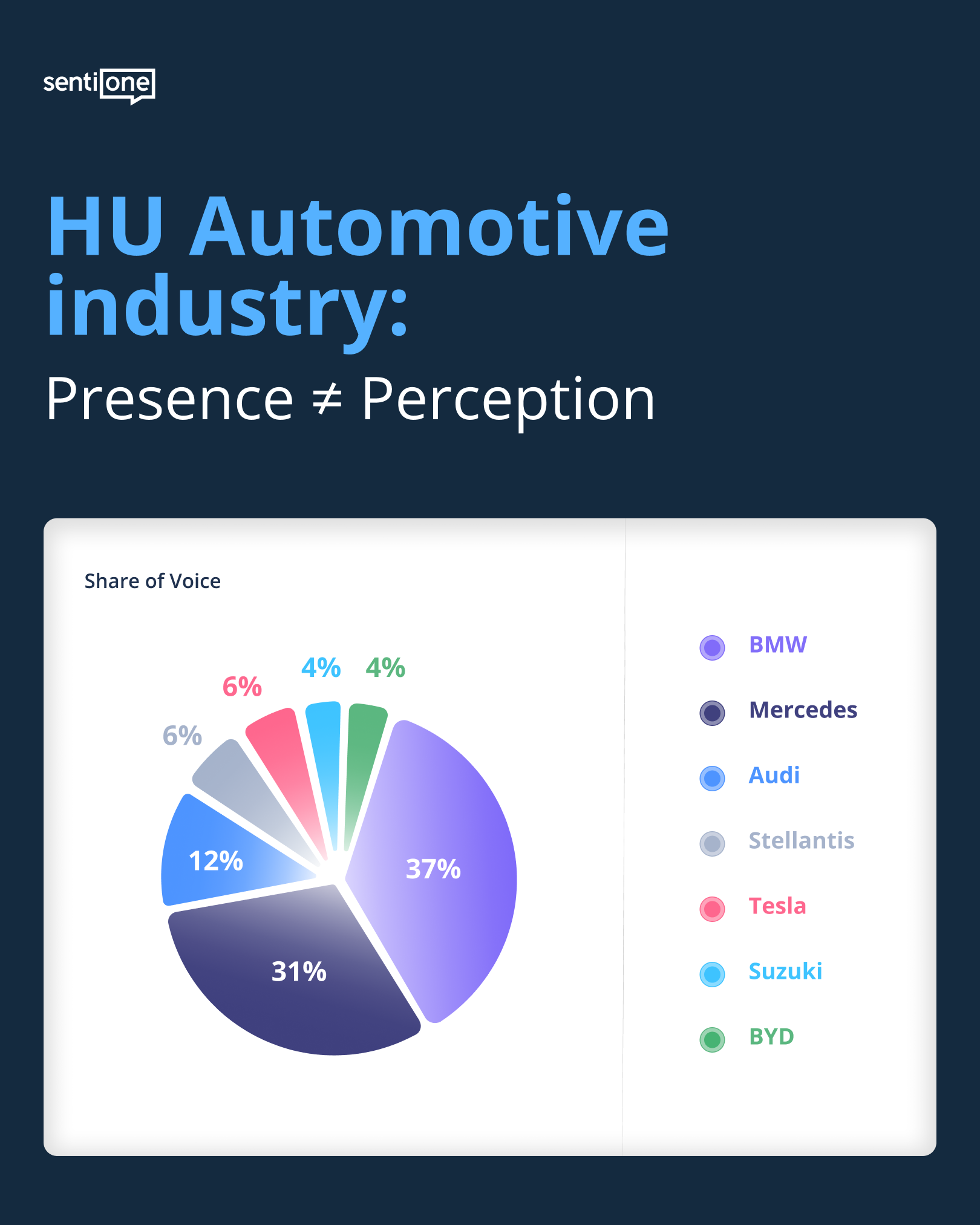

🚗 Brand Share of Voice: BMW and Mercedes Dominate the Conversation

Based on SentiOne’s tagging data, BMW and Mercedes-Benz clearly lead the online conversation around Hungary’s automotive industry:

- BMW – 36.61% of all tagged mentions

- Mercedes-Benz – 30.95%

- Audi – 12.48%

- Stellantis (Opel) – 6.19%

- Tesla – 6.00%

- Suzuki – 4.26%

- BYD – 3.53%

These figures reflect both traditional media coverage and consumer-driven content. BMW’s share is fueled by enthusiasm around its new Debrecen plant and model launches, while Mercedes dominates labor-related news and performance narratives linked to its Kecskemét factory.

Notably:

- Audi’s visibility lags behind its production presence — suggesting limited community interaction or proactive media activity.

- BYD, despite opening a factory in Hungary, holds a modest 3.5% share — pointing to limited public awareness or engagement so far.

- Tesla maintains relevance even without a Hungarian plant, driven by consumer comparisons and general EV discourse.

👉 Why it matters: BYD’s low share — despite a major factory investment — shows that visibility isn’t guaranteed by infrastructure alone. Community engagement and proactive communication are essential for winning hearts in a crowded market.

🔍 What People Talk About: Themes from the Ground

Negative Sentiment

- Frustration with customer service, product quality, and unexpected software updates

- Complaints about high maintenance costs, language settings, and vehicle features not working properly

- General concerns about the European automotive model, labor issues, and corporate decisions impacting local economies

Positive Sentiment

- Strong brand enthusiasm for BMW, Audi, and Mercedes — especially around high-performance models like the BMW M5 and Audi A7

- Passionate communities discuss cars in the context of Formula 1, gaming, and real-life aspirations

- Conversations around luxury, design, and community identity

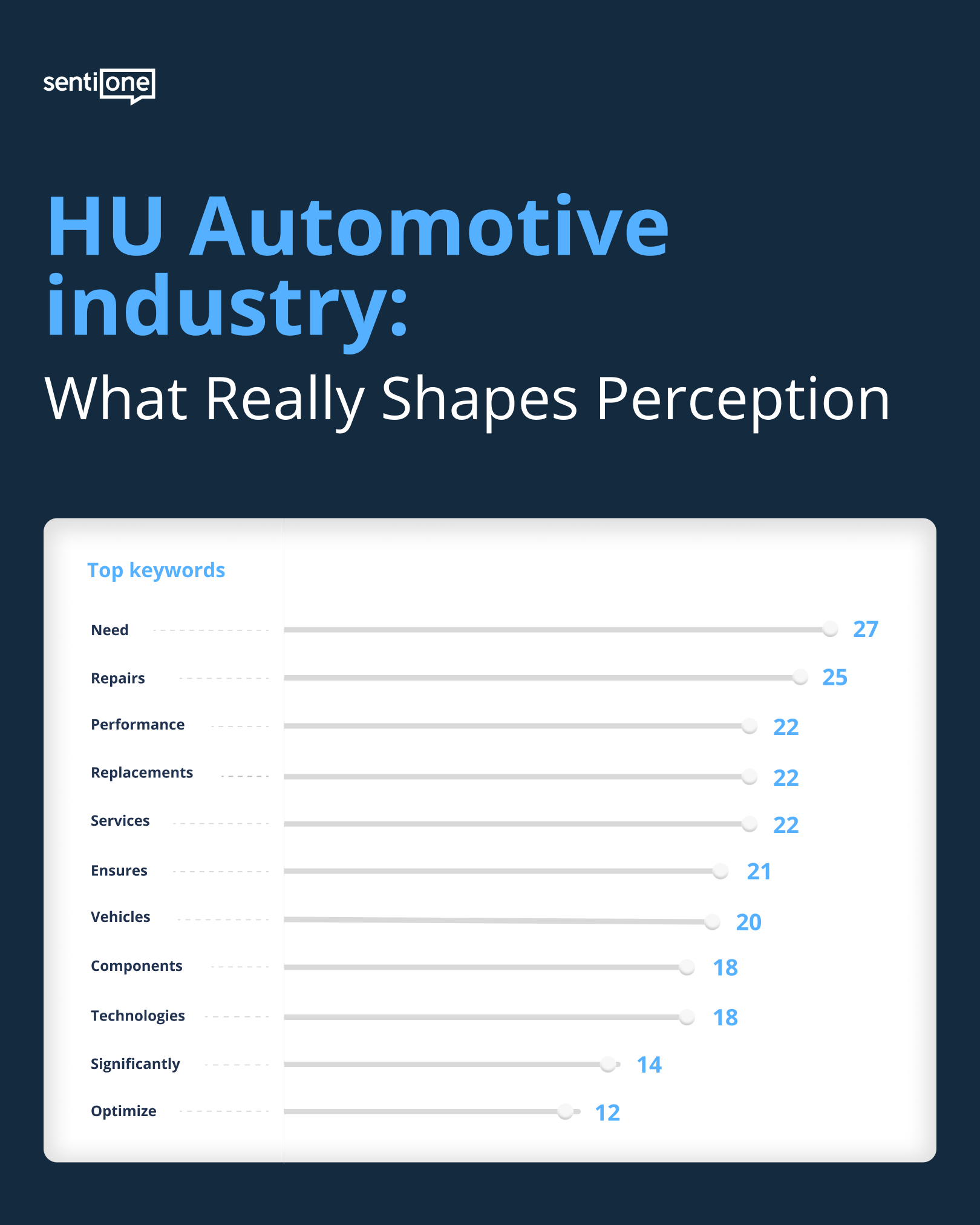

Top Keywords

Among negative mentions, functional topics dominate:

- Repairs, replacements, services, components

- Also: “performance”, “optimize”, “technologies”, “vehicles”

👉 Takeaway:

While headlines focus on innovation, most public friction happens in the day-to-day: repairs, service, and usability. For brands, this suggests that operational excellence often matters more than marketing narratives.

This suggests that beyond headlines, the daily experience of ownership and maintenance is what drives long-tail conversation — especially among brand-loyal customers.

🇭🇺 Hungary’s Position in a Shifting Industry

Outside the social data, Hungary’s automotive scene continues to evolve:

- BYD‘s entry into Hungary marks China’s growing influence on the European EV space.

- BMW’s Debrecen plant is set to be one of the most modern in Europe, focused on e-mobility.

- The Hungarian government remains aggressive in attracting FDI, offering incentives and positioning itself as a green automotive hub.

But alongside innovation come questions:

- Can Hungary’s labor model support sustainable growth?

- Will the public embrace the green shift, or view it with skepticism?

- Is there enough investment in the social dimension of this economic boom?

🎯 Key Takeaways for Industry Stakeholders

- Labor relations drive visibility. Mentions spike when compensation or protests enter the narrative — companies must prepare for scrutiny.

- Luxury brands win hearts, but service gaps hurt. High-end models inspire passion, but support issues tarnish perception.

- Media leads the conversation. Owned content and press coverage are still the most influential channels.

- Repair and longevity matter. Daily user experience is just as relevant as innovation.

- EV transition is visible, but not dominant (yet). More proactive public engagement could solidify trust in Hungary’s green future.

Final Word: Manufacturing Growth Meets Public Perception

Hungary’s automotive sector may be expanding rapidly on the ground – with record exports, new EV factories, and strategic partnerships – but public sentiment is still catching up.

The data shows that trust is built on more than just innovation. Labor conditions, after-sales experience, and community identity shape how people perceive this industry. For brands operating in Hungary, these insights aren’t just interesting — they’re operationally relevant.

🧠 Want to understand how your brand is perceived in key markets?

Get in touch for a free brand audit and demo of the platform. Let’s explore how public sentiment could shape your next strategic move: sentione.com