How the UK’s Leading Car Brands Perform Online in 2025

The UK automotive industry is entering a decisive phase of electrification and brand repositioning. Using SentiOne social listening, we analyzed three months of online conversations around six leading brands — Volkswagen, BMW, Audi, Kia, Ford, and Mercedes-Benz. The results highlight not only who gets talked about, but how they’re perceived, where the conversations happen, and what drives consumer engagement.

1. Mentions and Reach

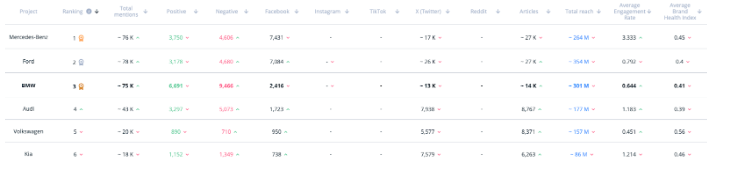

Mercedes-Benz leads overall online engagement, driven by its prestige and consistent visibility across multiple channels, especially Facebook and X (Twitter). Ford follows closely, maintaining a strong digital footprint with high total mentions and the widest reach, reinforcing its broad mainstream appeal. BMW ranks third, standing out for strong positive sentiment but also a notably high volume of negative mentions, suggesting that its bold design or product discussions are polarizing audiences. Audi demonstrates balanced engagement, marked by healthy reach and one of the highest engagement rates – signaling that its content resonates well with its audience. Volkswagen, despite fewer mentions, sustains a robust brand health index, reflecting solid consumer trust and stable sentiment. Meanwhile, Kia, though generating the fewest mentions, achieves impressive engagement efficiency, showing that impactful storytelling and targeted communication can outperform sheer volume.

Takeaway: Big spikes create visibility, but Kia proves that even smaller brands can achieve an outsized impact with the right narrative.

2. Sentiment and Brand Health

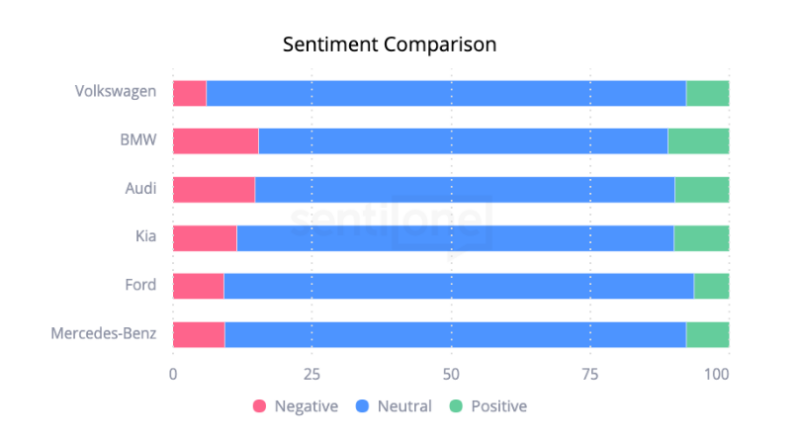

Mercedes-Benz continues to command strong brand presence, but its sentiment leans more neutral than enthusiastic – a sign that prestige alone may not sustain emotional engagement. Ford and Volkswagen mirror this pattern, with audiences associating them with consistency and dependability rather than excitement. BMW and Audi generate more polarized reactions, balancing admiration for innovation and performance with criticism around design choices and ownership experiences. Kia, on the other hand, shows one of the healthiest sentiment balances, earning high positivity relative to its conversation volume, reflecting strong public approval for its value-driven positioning and electric vehicle advancements.

Takeaway:

A high share of voice means little without goodwill. Mercedes-Benz and BMW may dominate attention, but Kia’s positive sentiment shows that authenticity and customer satisfaction can turn smaller conversations into powerful advocacy, proving that quality of perception ultimately drives brand resilience.

3. Engagement and Awareness

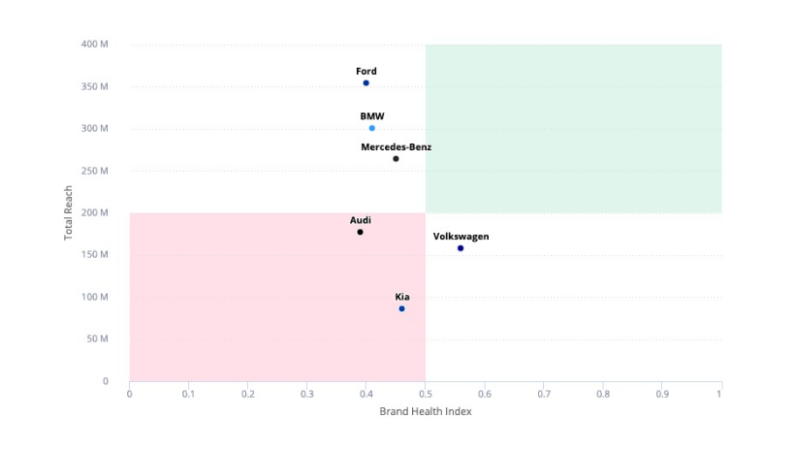

Ford leads in total reach, underscoring its strong visibility and mass-market appeal, while BMW and Mercedes-Benz also secure top-tier exposure, confirming their dominance in public awareness. However, their brand health scores remain moderate, suggesting that high visibility hasn’t fully translated into strong consumer sentiment. Volkswagen stands out with a healthier brand index despite lower reach, reflecting a more trusted and stable reputation among its audience. Audi and Kia occupy the lower-left quadrant, indicating limited reach but meaningful opportunities to strengthen brand affinity. Kia, in particular, shows potential: its improving brand health hints that its growing EV narrative is beginning to resonate, even if its current exposure remains modest.

Takeaway:

Reach builds recognition, but trust sustains relevance. Ford and Mercedes may lead in visibility, yet Volkswagen’s steadier sentiment — and Kia’s upward momentum — highlight that genuine connection often matters more than sheer scale.

4. Geography of Conversations

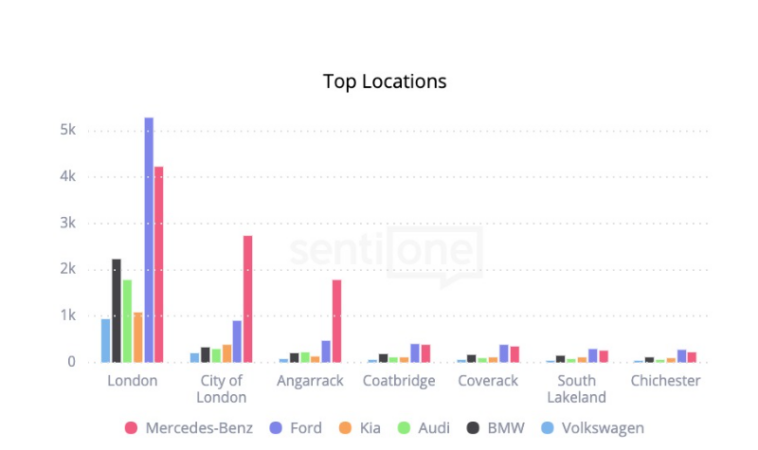

London dominates the conversation landscape, serving as the primary hub for all major automotive brands – especially Ford and Mercedes-Benz, which lead by a wide margin. Ford’s strong presence across both London and smaller towns like Angarrack and Coatridge suggests widespread appeal rooted in practicality and everyday usability. Mercedes-Benz, meanwhile, stands out in metropolitan and affluent areas such as the City of London, reflecting its continued association with luxury and premium lifestyles. Other brands like BMW, Audi, and Kia maintain modest but consistent visibility across secondary regions, indicating potential for growth through targeted local engagement.

Takeaway:

Regional nuances matter. While Ford and Mercedes excel in their core markets, brands like Audi, Kia, and Volkswagen can gain ground by tailoring messages to local preferences, proving that precision in geography can be as powerful as scale in visibility.

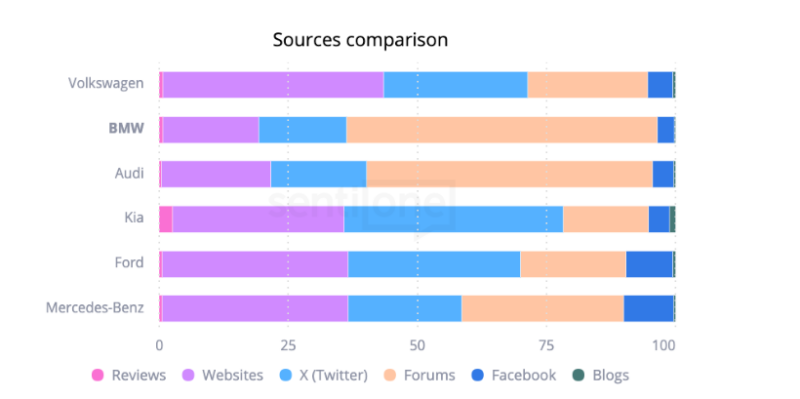

5. Sources of Conversations

Conversations about automotive brands were fueled primarily by websites and X (Twitter), underscoring the power of fast-moving digital channels in shaping public perception. BMW and Audi benefited most from forum discussions, a space where enthusiasts exchange detailed opinions on performance, design, and reliability, extending their narratives well beyond momentary buzz. Volkswagen and Ford maintained balanced visibility across multiple sources, suggesting a well-rounded media presence. Meanwhile, Mercedes-Benz stood out for its strong presence on Facebook, reflecting its ability to engage more lifestyle-oriented audiences, while Kia’s coverage leaned heavily on website mentions and consumer reviews, reinforcing its credibility through third-party validation.

Takeaway:

Every source adds a distinct layer to brand perception: social channels ignite conversations, news and websites amplify them, and forums sustain them over time. The most resilient brands are those that master all three, turning short-term buzz into lasting reputation.

6. Consumer Topics and Associations

Electrification was the strongest theme, from BMW’s iX3 to Audi’s e-tron GT and Kia’s EV6. Design polarisation (BMW’s grille, Audi’s new styling) sparked debate, while heritage lifted both BMW and Volkswagen in nostalgic conversations. Service quality, especially at Audi dealerships, surfaced as a negative theme that damaged brand perception.

Takeaway: The stories consumers tell online reveal both strengths to double down on (EV innovation, heritage) and weaknesses to fix (service quality).

Conclusion

The digital landscape for automotive brands in 2025 paints a clear picture: visibility alone no longer guarantees influence. While giants like Mercedes-Benz, Ford, and BMW dominate total mentions and reach, their impact varies widely depending on sentiment, channel strategy, and audience engagement depth. The data reveals that true strength lies not only in how loud a brand is heard, but in how positively it resonates and how long it stays relevant in the conversation.

Kia continues to prove that smaller brands can punch above their weight. With fewer mentions but consistently high engagement and positive sentiment, Kia exemplifies how authenticity and clear storytelling (particularly around EV innovation and accessibility) can translate into strong goodwill and brand health. Volkswagen, meanwhile, showcases steadiness: fewer spikes in attention but a solid, trust-based foundation that reflects long-term credibility.

BMW and Audi remain conversation powerhouses, driven by innovation and design — yet their polarizing appeal highlights the double-edged nature of high visibility. Innovation invites admiration, but also scrutiny. Mercedes-Benz and Ford, for their part, underscore the value and risk of legacy: prestige and familiarity draw attention, but can make it harder to spark new, emotionally charged engagement if not continuously refreshed.

Regional and channel dynamics add further nuance. London and other metropolitan centers drive the bulk of discussion, but smaller communities (from Angarrack to South Lakeland) show meaningful engagement potential when brands localize their approach. Across channels, X (Twitter) and forums remain essential for shaping narratives and sustaining dialogue, while Facebook and news sites amplify reach and reinforce perception. Each platform plays a unique role in how stories unfold and persist over time.

Ultimately, the lesson is clear: brand health is built on balance: between reach and resonance, volume and sentiment, innovation and trust. Automotive brands that adapt their messaging across geographies, manage sentiment proactively, and maintain consistent storytelling across digital ecosystems will not only capture attention but earn lasting advocacy.

Key Takeaway:

In 2025’s fast-evolving automotive conversation, the winners won’t just be the loudest. They’ll be the most meaningful. Those who turn visibility into value, engagement into emotion, and mentions into loyalty will define the next era of automotive brand leadership.