Hello, How Can I Help You? A Look at the Chatbots in Insurance

Table of contents

The world’s digitisation continues, and customers’ habits and expectations change thoroughly. Comparing competing offers has never been easier, and better-informed customers demand higher standards. All industries seek to evolve accordingly, looking up to AI to improve and automate their processes. Underwriting companies’ perspective is no different, facing the promises of automated risk assessment and employing chatbots in insurance.

Policies for the future

The research is evident: insurers must pay close attention to brand-new consumer tech. Today we sport over a billion smart wearables as the Internet of Things slowly creeps into our homes. Right now, connected cars might still be for the privileged, but by 2030 they will constitute 96% of all shipped cars. All these things collect our data. They track our health and sleep habits, how we drive, and how we live.

Increasingly, policy buyers are willing to trade their data for cheaper premiums. 64% are comfortable with insurers processing information from their wearables, and almost 50% – from their cars. This growing tech-savvy demographic highlights flexible, personalised programs as a significant factor in brand loyalty. They expect offers tailored to their lifestyles.

Simultaneously, people change their approach to customer service. We grew accustomed to dealing with brands through messaging. 57% of customers expect brands to become available 24/7 within the next few years.

For all these reasons, insurers must reimagine their customer experience (CX). On the one hand, they need systems that process complex clients’ data, create accurate risk profiles and turn them into personalised high-value offers. On the other, they need easily accessible and flexible customer service to utilise those efficiently.

In short, they need AI…

…and they know it. Global insurance spending on AI platforms will reach $3.4 billion by 2024, as stated by a report from Insider Intelligence. Over 60% of European insurers plan to invest in digital CX, proving that the industry prioritises improving customer service above other goals. Virtual assistants, such as voicebots and chatbots, are at the exact intersection of these trends.

Freshdesk determined that the bot implementation improves consumer satisfaction rating by 7%. Insurance industry chatbots can cover enormous call and messaging volumes, alleviating issues with overloaded call centres. Unlike human workers, they’re available 24/7 and don’t require customers to wait on calls. The very same AI can manage both voice and messaging channels simultaneously.

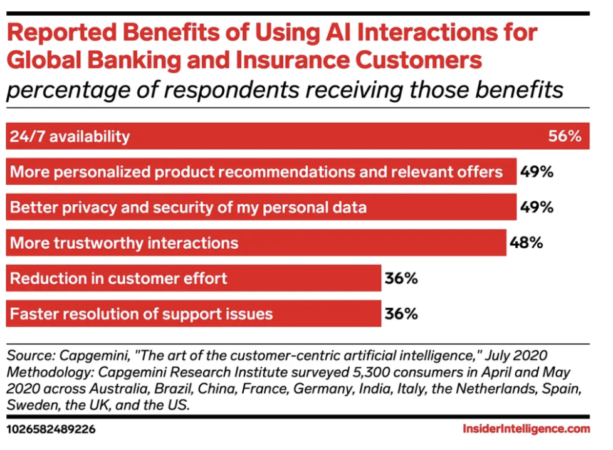

Virtual assistants can access customer profiles instantly and offer recommendations based on their insurance status, history and lifestyle. Almost 50% of clients report that AI interactions provide more relevant offers, better privacy and more trustworthy interactions.

Sounds promising?

If so, let’s look at customer service processes within the insurance industry that a chatbot (a text bot on social media, a website, or a mobile app) or a voicebot (a voice assistant in a call centre) can improve significantly.

If you’re new to these technologies or otherwise confused, perhaps our Guide to Chatbots or Guide to Voicebots will get you off the ground.

So, what is there to gain for insurance companies using chatbots?

Easier customer authentication

Whenever a customer calls a call centre, they waste time in a queue followed by a mundane authentication process. Client’s ID, social security number, or mother’s maiden name – there is no reason for a human worker to carry it out. Since every customer requires verification, voicebots automating this process generate considerable savings and significantly speed up call centre service.

AI introduces new ways of biometric identification, such as voice recognition. It integrates seamlessly into the voicebot’s algorithm, allowing for reliable client authentication without interrupting the conversation.

Gathering sales leads 24/7

Any visitor to the company’s website can become a lead. A chatbot can streamline converting these leads into sales or remember the hesitant ones to provide opportunities for remarketing. Machine learning helps it predict customers’ expectations based on previous interactions. It can answer questions, calculate insurance rates, prepare personalised offers and assist customers with filling out forms. The AI chatbot serves as a guide and allows the customer to take control of the purchasing process.

Streamlining insurance claims

Processing an insurance claim can take days and engage several underwriting assistants. It is a stressful hold-up for customers, and checking the application status requires contacting the representative. Chatbots simplify this procedure on both ends. They can interview claimants about the damage, pull up their customer’s data and prepare a comprehensive report for a decisional representative. At the same time, they will keep the customer in the loop without troubling the employees.

Research shows that 44% of US consumers would be comfortable filing chatbot insurance claims for cheaper premiums.

Replacing IVR in call centres

IVR systems, known as automated voice menus, haunted helplines for years to everyone’s misery. They involve lengthy keypad menus with most options irrelevant to the customer’s issue. They rely solely on predefined paths and the availability of workers.

Luckily, thanks to the development of Natural Language Understanding (NLU) algorithms, voicebots successfully replace IVRs. AI understands customers’ inquiries and responds by solving the problem or redirecting the caller to the proper department. It is flexible as it learns and re-learns procedures according to insurers’ and clients’ changing needs. One-time offers, better sales techniques or announcements implement immediately.

Voicebots save customers and service representatives time and reduce the waiting time on calls. A single AI handles up to 1,000 calls and scales as you please, depending only on your hardware’s processing power.

Benefits of chatbots in insurance industry:

Conversational AI for insurance is one of the industry’s critical developments for the next decade.

It reduces workload, costs and queues

With AI’s help, we reduce the time spent on helpline calls. Answering common inquiries and handling claim procedures reduce queues and cut costs. Insurers can direct the workforce where human judgement proves necessary and allow automation to improve customers’ and employees’ lives.

It improves sales and lead generation

Chatbots are sales agents who never sleep, never forget and learn faster than humans. They can bring your customers closer to the brand and increase their loyalty. They effortlessly gather remarketing leads. They generate vital insights for your sales team on clients’ expectations, sales statistics and bounce rates.

It is flexible and scales like crazy

AI chatbots and voicebots adapt to the growing call volume and web traffic without adding to the cost. That makes them reliable in times of crisis or rapid growth. As long as your hosting can provide the necessary computing power – AI has you covered.

Is there a catch?

Well, there isn’t one. At least not necessarily. To properly do its job, a conversational AI in insurance processes customers’ sensitive information, accesses devices and records health, exercise and driving habits. Passing on personal and financial data to the chatbot creates security risks and…

Privacy concerns

Identity proofing is one of the crucial issues. The insurer must guarantee that only authorised people can access the protected data. It needs protection from both data theft and nosy staff members. Biometric authentication solutions such as face/voice recognition improve security but require a thoroughly safe hosting of even more sensitive data.

Let’s not forget that NLU algorithms constantly learn from their previous interactions. And to do so, they need proper storage of conversation transcripts. Transcripts insurers must anonymise, sanitise from irrelevant personal information, and host securely.

Cloud vs on-premise hosting

There are two ways to host a chatbot’s AI and the necessary data: on-premise or with cloud computing.

On-premise means that the company hosts the data. That requires proper hardware and maintenance, which can be expensive. On the other hand, it offers better reliability, security, and complete control and ownership of the data.

Cloud computing means that a third-party server stores the data. It significantly lowers costs and allows for quicker deployment and convenient scalability. Unfortunately, it muddles the status of “who owns the data”, makes the insurance company dependent on a third party, and creates considerable security risks.

Recent studies show that almost 98% of companies experience cloud security breaches. And security breaches are something you’d like to avoid at all costs when handling your customers’ sensitive information.

Legal pitfalls

Chatbot’s data processing policies need full compliance with regional data protection laws such as GDPR in the EU or HIPAA in the US. If it integrates with a third-party platform, AI has to follow its privacy policies. That’s far easier to ensure when the company maintains control and ownership over data.

To summarise:

To fully benefit from AI bots in the insurance industry, you must handle lots of sensitive data. To protect your customers, reputation, legal safety, and revenue, you need to store that data in a secure and reliable place. And that means on-premise hosting.

SentiOne specialises in on-premise deployments, which gives enterprise companies the highest security and control. Furthermore, our solutions are fully compliant with the GDPR.

Try insurance chatbots for yourself

Here at SentiOne, we aim to build bots that understand natural spoken language the way humans do. Thanks to access to large datasets from social listening and a dedicated R&D team of AI engineers and linguists, our SentiOne intent detection engine achieves an accuracy of 94%.

We are working with leading European insurers and providing them with chatbots designed for lead generation, voicebots for call centres and mobile apps to service their existing customers.

If you’re interested in implementing voicebots/chatbots in your company, look no further. SentiOne Automate will help you utilise conversational AI potential and build an insurance chatbot tailored to your needs.

Learn more about the SentiOne Automate, or talk to us if you want to try it out.